If you are running the business, you are aware of how crucial it is to manage the financial statements and accounts payables. If you can’t do this, you might pay for it and lose your precious resources and capital. Therefore, you need to focus on managing the financial statements that open the opportunities for your business to grow and ripen.

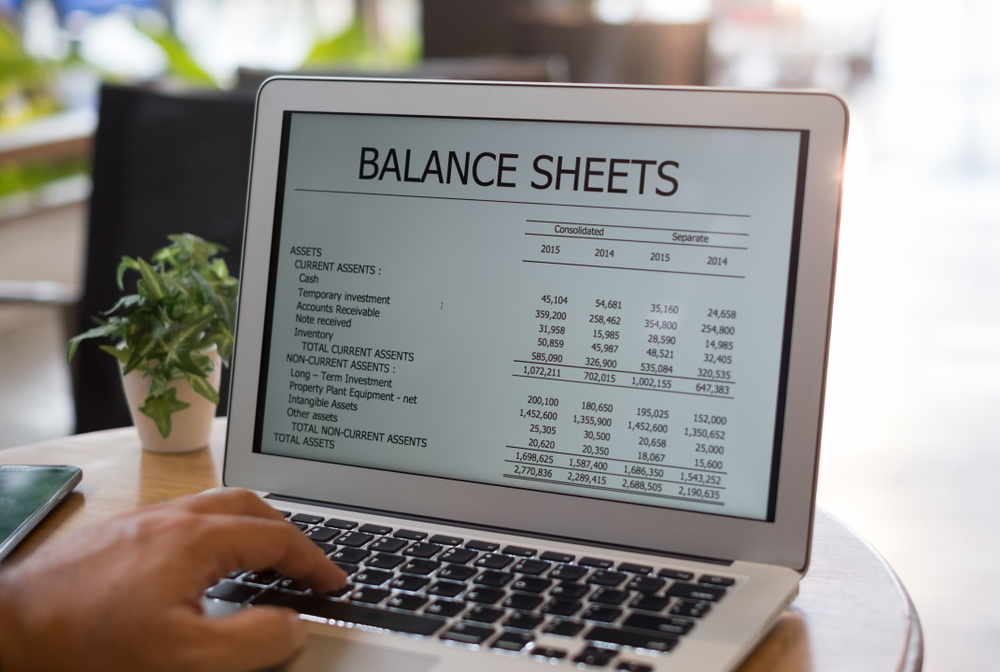

Let your business reach the glory of success by analyzing every aspect of your business. For this reason, you must maintain your balance sheet, which poses all the assets and liabilities of your business. In this way, you will gather all the data of your business liabilities on one page, enabling you to analyze all the activities easily and comfortably. If you fail to maintain your sheet and you must consider this article. In this article, you will discover the 5 reasons why your balance sheet is unbalanced that will eventually support you in removing the vulnerabilities from your financial operations. So, stay with us here and keep scrolling below to identify the notion.

Top 5 Reasons Why Your Balance Sheet Is Unbalanced

A balance sheet is a financial statement that poses all the liabilities and assets of your company. The important thing is that your company’s liabilities must be similar to the balance sheet that provides you with detailed information about the expanse of your services and products. Therefore, you must maintain your balance sheet without error or fault. The blunder or error puts all your efforts and exertions in vain, affecting your profitability. So, what can you do to fix the error on the balance sheet? But before getting the answer to this question, you have to know what factors influence your balance sheet and make it unbalanced. Therefore, in this post, you will find the top 5 reasons your balance sheet is unbalanced. So, keep an eye on this page and keep reading below.

1. Data Damage or Misplaced Data

Your business development must keep your balance sheet effective. But some discrepancies in the financial report damage your entire data, and you might face unbearable consequences. According to the research, using Quickbooks might give you more chances to misplace your data and acquire transaction damage problems. Also, human error becomes another reason for data damage. Therefore, you must double-check all your data when generating the report and during the audit. If you conduct an authentic audit, you will surely identify the vulnerabilities and mistakes at the initial stage and avoid the massive demolition of the financial assets.

For this reason, you have to approach professional audit services that effectively manage all your financial reports. Thus, we suggest you explore the services from the Accounting firms in Abu Dhabi to get accurate and authentic reports. It will surely generate an accurate balance sheet that matches the company’s assets and liabilities and avoid errors and misplacements.

2. Incorrectly Entered Transactions

Incorrect transaction entry on the balance sheet is a common human error that affects all the balance sheet calculations. Sometimes, you can enter inaccurate transactions, ignore the entry of the figures, and add extra digits that lead to faults occurring in the final report. You might serve several hours to discover the mistakes. Therefore, to save from this headache, you have to double-check and then cross-check your financial statements.

Read also: Definitive Guide for Accounting Professionals

3. Dealing with Different Currencies

If your business is spread all around the world, then you must deal with different currencies. Managing all the transactions on a single book will be tough in this scenario. Variations in the exchange rate lead to errors in the financial statement, resulting in an inaccurate balance sheet.

4. Equity Calculations

Error in manipulating the equity calculation is another reason of unbalance sheet. Therefore, you must thoroughly analyze the owner’s equity’s total worth, similar to the balance sheet. Otherwise, there must be an error in the equity. So, be organized and conscious while calculating the vice versa that must be similar to the assets and liabilities of the organizations.

Read also: Challenges of SME Accounting and Bookkeeping Services

5. Change in Inventory

Change in inventory is also the main reason for making your balance sheet unbalanced and affecting all the cash flow statements. Evaluating and subtracting the last month’s inventory from the existing inventory is difficult. Therefore, you have to get the assistance of a professional accountant that perfectly manages all the inventories promptly and prevents all the risks associated with inventory accounting.

Therefore, you have to approach the best-chartered accountant firms in Abu Dhabi to get the assistance of a competent and professional accountant. It will effectively manage all the payable receives, cash flow, inventory statements, and other financial tasks and provide accurate and authentic reports and balance sheets.

Wrapping Up

The discussion mentioned above surely assists you in removing errors and vulnerabilities from your balance sheet. Therefore, consider these tactics while preparing your balance sheet and don’t forget to get the support of a professional accountant. It will surely assist you in managing all the financial statements effectively and provide you authentic and accurate balance sheet that matches your liabilities and assets. In this way, you will save plenty of assets that ultimately lead your business towards the glory of success.